Europe keeps burning more palm oil in its diesel cars and trucks

Europe keeps burning more palm oil in its diesel cars and trucks (Briefing) / Transport & Environment, Brussels, November 2016, 4 p. [formato PDF, 254 kB].

English original in Transport & Environment, November 2016.

Italian article in Altreconomia

In May 2016 Transport & Environment identified that in 2014 biodiesel was the largest outlet for palm oil in the EU, and the second largest feedstock used in biodiesel after rapeseed oil. The figures used for analysis were based on leaked data from Fediol, the trade association of the EU vegetable oil and protein meal industy.

This briefing shows the development from 2014 to 2015 based on data from the annual report of OILWORLD, an independent market analysis publication working on vegetable oils. This brief also identifies the main countries in the EU where palm-oil biodiesel is produced, based on OILWORLD estimations.

In our previous analysis of the Globiom study on EU biofuels’ land-use change emissions, we showed that by 2020 biofuels increase EU transport GHG emissions by 4% – equivalent to 12 million cars extra cars on our roads. The main culprit is vegetable oil-based biodiesel, which on average has 80% higher GHG emissions than fossil diesel. Palm-oil biodiesel emissions are a whopping 303% of the fossil baseline, mainly due to high land-use change emissions due to deforestation and peatlands drainage.

Palm oil use continues to grow

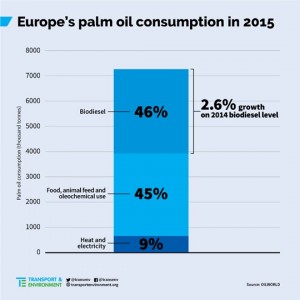

So how much did palm oil consumption grow between 2014 and 2015? The use of palm oil for biodiesel grew by 2.6% to 3.35 million tonnes in 2015. The total use of palm oil in the EU grew by 1.6%, to 7.3 million tonnes in 2015.

In 2015, the EU put 46% of the palm it imported into biodiesel, up from 45% in 2014. This implies that the Renewable Energy Directive (RED) has been incentivising the increased use of palm oil. It is, hence, of crucial importance that the European Commission delivers on its commitment to end land-based biofuels and stop growth of biofuels harmful to the climate, such as palm oil.

One of the underlying reasons for the growth in palm oil use for biodiesel is its price. The current 10% target in the RED is based on energy, or simply, volume. A volume-based target, does not incentivise bringing to the market fuels with the lowest GHG emissions (also known as best performing fuels). Rather, it allows the cheapest biofuels to take over the market, leading to a race to the bottom. Biofuels sold in Europe have to comply with sustainability criteria, linked directly to their production, but these cannot prevent knock-on effects of increased demand for, in this case, palm oil. Palm oil has been the cheapest of vegetable oils

available in the EU for the last 15 years, according to OILWORLD. In 2015 palm oil was on average about 130$/t – 17% cheaper than any other vegetable oil in Europe.

Land use of palm oil diesel

We estimate the current total land used directly in the tropics to produce palm oil for the EU biodiesel market at 0.92 million ha [1]. Globally 8.8 million ha of land-use change will be caused by the current EU biofuels policy to 2020, according to the Globiom modelling results. [2] The EU’s renewable energy policy will decrease global food production area by 0.6%, the size of Portugal, in the same period.

In 2015, 32% of biodiesel and 1.7% of diesel consumed in Europe came from palm oil [3] . If the rest of the world used the same share of palm oil for diesel production, 4.3 million hectares of tropical land would be needed – equivalent to all remaining peat swamp forests in Malaysia, Sumatra and Borneo [4].

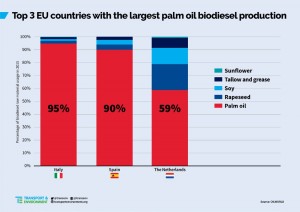

Spain, Italy and the Netherlands produce about 80% of the EU’s palm biodiesel

With 80% of market share, these three countries are the largest producers of palm oil-based biodiesel. While we know where biodiesel is produced, we do not know where the fuel is used, as the final product is traded on the internal market. No EU-wide requirement of public reporting on biofuel feedstocks exist, but some member states publish such information nationally. Analysing these sources, we learned that Spain and Italy use around two-thirds of their annual production, while the Netherlands exports almost all its

production of palm-oil diesel at the moment. Based on the national consumption data and OILWORLD production figures, the three largest producers consume 38% of palm-oil biodiesel produced in the EU, showing it is a wider European problem, as over half of their produce is exported to other EU member states.

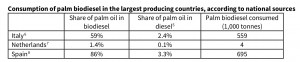

Consumption of palm biodiesel in the largest producing countries, according to national sources

Top 3 EU countries with the largest palm oil biodiesel production

Crop-based biodiesel needs to be phased out by 2025

- This briefing focuses on palm oil because it is the most climate-damaging of all virgin vegetable oil-based biodiesels; however, the Globiom study shows that also biodiesel made from soy, rapeseed and sunflower is worse for the climate than fossil diesel. The Commission needs to follow through on its commitment from July and phase land-based biodiesel out by 2025 at the latest, and bioethanol by 2030 at the latest;

- Earlier work by Ecofys for T&E shows that 95% of biodiesel installations will have turned a profit in 2017; phase-out by 2025 is economically feasible;The ‘phase-out’ needs to mean that all land-based biofuels above the EU-wide cap cannot count towards member states’ renewable energy targets. This is already the case with the current 7% cap;

- Land-based biofuels should not count towards member states’ climate targets under the Effort Sharing Regulation (ESR). As long as member states can count all biofuels as having zero emissions under the ESR, they will have a strong incentive to keep blending them in their transport fuels, because on paper this contributes to their ESR obligations. As explained in an earlier briefing, the draft proposal would introduce a 478 MT loophole, the size of France’s annual emissions, compared to a ‘proper’ phase-out.

Further information

Jori Sihvonen

Transport & Environment Biofuels Officer

Jori.sihvonen@transportenvironment.org

+32(0)2 851 0228

_________________________________________________________

[1] Assuming the 2015 average yield of 3.61 t/ha/a from OILWORLD

[2] Ecofys, IIASA & E4Tech (2015) The land use change impact of biofuels consumed in the EU

https://ec.europa.eu/energy/sites/ener/files/documents/Final%20Report_GLOBIOM_publication.pdf

[3] OILWORLD for palm biodiesel, FuelsEurope for EU diesel use, IEA for global diesel use

[4] Miettinen, Shi & Liew. (2016) Land cover distribution distribution in the peatlands of PeninsularMalaysia, Sumatra and Borneo in 2015 with changes since 1990. Global ecology and Conservation.

[5] Palm diesel consumption from national sources divided by Eurostat nrg_102a 2014 road diesel consumption

[6] Gestore Servizi Energetici 2014 data

[7] Dutch emissions authority 2015 data

[8] La Comisión Nacional de los Mercados y la Competencia (CNMC) 2015 data